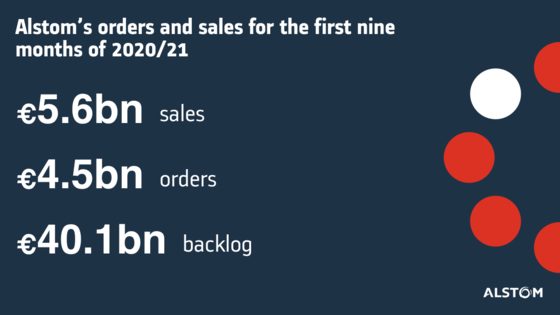

Alstom’s orders and sales for the first nine months of 2020/21

- Level of order intake at €4.5 billion, with solid order intake in Q3, and sustained record backlog at €40.1 billion

- 9 months sales at €5.6 billion, in line with targeted trajectory

- Full year outlook and mid-term 2022/23 guidance confirmed, supported by positive Q4 commercial pipeline and mid-term rail market perspectives

- Alstom leadership in ESG confirmed

19 January 2021 – Over the third quarter 2020/21 (from 1 October to 31 December 2020), Alstom booked €1.8 billion of orders. The Group’s sales reached €2 billion (+2% organic versus last year).

For the first nine months of 2020/21 (from 1 April to 31 December 2020), Alstom’s order intake reached €4.5 billion. The Group’s sales reached €5.6 billion in line with targeted trajectory.

The backlog, on 31 December 2020, reached €40.1 billion and provides strong visibility on future sales.

Key figures

|

Actual figures |

2019/20 |

|

|

|

2020/21 |

|

|

2019/20 |

2020/21 |

Var. % |

Var. % |

|

|

(in € million) |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

9 months |

9 months |

Actual |

Organic |

|

|

Orders received |

1,620 |

2,998 |

3,563 |

1,719 |

1,651 |

1,001 |

1,836 |

8,181 |

4,488 |

-45% |

-45% |

|

|

Sales |

2,054 |

2,086 |

2,060 |

2,001 |

1,507 |

2,011 |

2,049 |

6,200 |

5,567 |

-10% |

-8% |

Geographic and product breakdowns of reported orders and sales are provided in Appendix 1. All figures mentioned in this release are unaudited.

“During the third quarter, Alstom secured various large orders in Europe and Asia-Pacific, including an emblematic signalling contract between Delhi and Meerut in India. Regarding sales, the ramp up of our major rolling stock projects is continuing this quarter along with signaling contracts. Alstom leadership in Corporate Social Responsibility and Sustainability were recognized by the Dow Jones Sustainability Indices and by global environmental non-profit CDP. Finally, we are very close to opening a new chapter in our history by finalizing the acquisition of Bombardier Transportation on January 29th”, said Henri Poupart-Lafarge, Alstom Chairman and Chief Executive Officer.Geographic and product breakdowns of reported orders and sales are provided in Appendix 1. All figures mentioned in this release are unaudited.

***

Detailed review

During the third quarter of 2020/21 (from 1 October to 31 December 2020), Alstom recorded €1,836 million of orders, versus €3,563 million in Q3 2019/20 which was notably high with large orders. Europe accounted for the majority of the orders of the Group with notably one large metro system contract in Toulouse worth more than €470 million. It also included large rolling stock contracts with the supply of up to 30 Metropolis™ trains in Romania and 64 low-floor tramways in Germany.

Orders in Signalling and Services were positive with respectively €452 million and €431 million booked during the quarter. Alstom has notably been awarded its first contract in Mainline Signalling in India worth €106 million for ETCS between Delhi and Meerut.

Regarding sales, €2,049 million were traded in the third quarter 2020/21 (from 1 October to 31 December 2020) versus €2,060 million in Q3 2019/20. These slightly growing sales (+2% organic) are mainly due to a ramp-up in Rolling Stock and Signalling, which compensated the anticipated decline of Systems and a decrease in Services. Signalling sales increased significantly by 10% organic and reached €425 million. Compared to Q3 2019/20, Rolling Stock sales grew by 9% organic with continued ramp-up. Systems anticipated decline by 23% organic compared to Q3 2019/20 is due notably to contracts nearly completed in Middle-East. Services, impacted by Covid-19, show a decrease at 7% organic.

***

Main events of the third quarter 2020/21

- Key project deliveries

In November 2020, the SriCity factory in Andhra Pradesh that manufactures Rolling Stock for Urban Metro projects, successfully completed production of its 500th Metro Car. As Alstom’s largest Urban Rolling Stock manufacturing unit in the Asia-Pacific region, this facility is delivering metro trainsets to not only Indian cities but also worldwide. The currently operational metro trainsets built at this facility have clocked over 27 million kilometres cumulatively.

Alstom has successfully completed phase 1 of the Light Rail Transit project of Lusail, a planned city currently under construction near Doha, Qatar. This phase of the project is covering 9.7 km of single-track catenary-free and 12.8 km of single-track underground line. The operation of the network will be executed with Citadis X05 new generation trams with a capacity of 209 passengers utilizing both catenary and catenary-free technology (APS).

- Investment

In December 2020, Alstom finalised the acquisition of a minority stake in Cylus, an Israel-based cybersecurity specialist. Together, Alstom and Cylus will integrate cybersecurity technology into railway processes, components, and solutions. The technology will be implemented first in the Tel Aviv metropolitan light rail system with a capacity of 200,000 passengers a day.

- Smart and green mobility

In October 2020, for the first time in France, a locomotive has run in partial autonomy, under real operating conditions, with fully automated acceleration and braking functions. The consortium, consisting of Alstom, Altran, Apsys, Hitachi Rail, Railenium and SNCF, carried out all the steps that made this important trial possible: from the design to the description of the computer systems, cabling and software programming. The next key stage of the project will be the circulation, at the end of 2021, of a train with the same level of partial autonomy on a line equipped with lateral signalling[1] without any modification to the infrastructure.

In November 2020, Alstom’s innovative predictive maintenance solution for rolling stock, HealthHub™ TrainScanner™, has entered in service in Warsaw’s Pendolino Service Centre, where it will be used to maintain the fleet of 20 Avelia Pendolino™ operated by PKP Intercity. TrainScanner™ provides predictive maintenance and continuous assessment of rolling stock’s technical condition. TrainScanner™ and HealthHub™ provide significant benefits in terms of both maintenance and operation, lowering the consumption of materials and the number of required maintenance activities, and thus enabling significant savings for fleet owners and operators.

Finally, in November 2020, the board of FNM, Lombardy’s leading public transport group, approved the supply by Alstom of six hydrogen fuel cell trains, with the option for eight more. This order confirms the leading position of the Group in green mobility and more specifically on this promising new hydrogen market.

***

Alstom leadership in ESG confirmed and rewarded during this third quarter

During the third quarter of 2020/21, Alstom reached two significant recognitions of its Corporate Social Responsibility and Sustainability leading efforts. Alstom has attained the highest possible score of “A” in the 2020 annual assessment for transparency and leadership on climate issues, run by the global environmental non-profit CDP. This shows an improvement over last year’s score of “A-“, underlining Alstom's commitment, robust policy and demonstrable actions to cut emissions and contribute to the development of the low-carbon economy. Alstom is one of a small number of high-performing companies out of 5,800+ that were scored.

For the tenth consecutive year, Alstom has been included in the Dow Jones Sustainability Indices (DJSI), World and Europe, attesting to its leadership position in sustainable business practices. The Company reached an overall score of 78 out of 100 in the Corporate Sustainability Assessment (95% percentile 2020). Alstom has maintained its ranking amongst more than 7,300 assessed companies, now being part of the Top 5% of the best scored companies in its industry. This year, Alstom has significantly improved its assessment in the areas of codes of business conduct, policy influence and social reporting.

***

Bombardier Transportation acquisition update

On December 3rd, 2020, Alstom achieved a decisive milestone in the acquisition of Bombardier Transportation with the large success of its capital increase with a subscription rate of approximately 170%.

On January 5th 2021, Alstom successfully carried out an 8-year € 750 million senior bond issuance at a 0% fixed coupon. The proceeds of the issue of the bonds will be used for general corporate purposes including the financing of part of the acquisition of Bombardier Transportation complementing the capital increases.

All the regulatory approvals necessary for the completion of the Acquisition having been received, the completion of the acquisition is expected to take place on January 29th, 2021.

***

Outlook for fiscal year 2020/21[2]

In 2019/20, the Group launched the Alstom in Motion (AiM) strategic initiative and has since been taking steps to deliver revenues and margin growth in line with the objectives set by this plan for 2022/23.

The Covid-19 crisis is negatively affecting the financial performance of the 2020/21 fiscal year. Yet, Alstom is anticipating a strong pipeline for H2 2020/21 and observed a solid production pick-up during Q2 and Q3 2020/21.Thus, Alstom targets the following outlook for the 2020/21 fiscal year, assuming that the ongoing Covid-19 situation does not have a material effect on production or on the commercial tendering schedule[3]:

- Commercial performance allowing a book to bill ratio above one;

- Sales between €7.6bn and €7.9bn;

- An adjusted EBIT margin in the 7.7% - 8.0% range;

- Breakeven to positive Free Cash Flow generation[4].

Mid-term outlook for fiscal year 2022/23²

The outlook given in connection with the May 12, 2020 annual results announcement is confirmed

In the context of the Covid-19 crisis, the objective of a 5% average annual growth rate over the period from 2019/20 to 2022/23 should be slightly impacted by the temporary slowdown of tender activity, yet the 2022/23 objectives of 9% aEBIT margin and of a conversion from net income to free cash flow above 80% are confirmed.

With a strong liquidity position, a demonstrated ability to deliver execution and profitability and the rapid launch of a cost and cash mitigation plan the Group is confident in its capacity to weather the crisis as well as to capture opportunities in a resilient rail market and contribute to the transition

towards sustainable transport systems.

This press release contains forward-looking statements which are based on current plans and forecasts of Alstom’s management. Such forward-looking statements are relevant to the current scope of activity and are by their nature subject to a number of important risks and uncertainty factors (such as those described in the documents filed by Alstom with the French AMF) that could cause actual results to differ from the plans, objectives and expectations expressed in such forward-looking statements. These such forward-looking statements speak only as of the date on which they are made, and Alstom undertakes no obligation to update or revise any of them, whether as a result of new information, future events or otherwise.

FY 2020/21 forecasts are based on Alstom’s scope of consolidation at the end of September 2020, therefore exclude any scope impacts from the expected Bombardier Transportation acquisition. They are mainly based on the following assumptions:

Alstom internal assumptions

- The sales improvement in the second semester as compared to the first semester will primarily come from a decrease in the Covid-19 related disruptions that affected Alstom during the first half of this fiscal year, and from the execution of its orders backlog.

- The adjusted EBIT margin improvement compared to the first semester will primarily come from additional volume, rigorous project execution, and the delivery of projected sourcing savings.

- Standardisation of engineering tools and processes together with design to cost, and optimisation of our footprint both for engineering and manufacturing, will also support the improvement of Alstom performance. In addition, digital transformation, combined with efficient discipline in overhead cost management, will contribute to the improvement of the adjusted EBIT margin.

- Improved cash generation over the second semester as compared to the first semester will mainly come from accelerated deliveries and commercial performance. It remains subject to usual short-term volatility in down- and progress payments from clients.

Macro-economic assumptions

- They have been established excluding any major variations in exchange rates of the currencies of the main countries outside of Euro-zone in which the Group generates its revenues, compared to the rates in effect as at 30 September 2020.

- They assume an overall stable political environment in areas where Alstom operates or delivers products.

- They assume the absence of Covid-19 crisis-related production slowdowns, arising from partial or full lockdown situations, that would exceed the lockdown measures in place on the date of this document and affecting either Alstom or its key suppliers. In addition, they assume that customer tenders scheduled for the second semester will not considerably shift to later periods and that train mileage for purposes of calculating indexed payments under maintenance contracts will not decrease very significantly during the remainder of the second semester due to the ongoing health crisis.

This press release does not constitute or form part of a prospectus or any offer or invitation for the sale or issue of, or any offer or inducement to purchase or subscribe for, or any solicitation of any offer to purchase or subscribe for any shares or other securities in the Company in France, the United Kingdom, the United States or any other jurisdiction. Any offer of the Company’s securities may only be made in France pursuant to a prospectus having received the visa from the AMF or, outside France, pursuant to an offering document prepared for such purpose. The information does not constitute any form of commitment on the part of the Company or any other person. Neither the information nor any other written or oral information made available to any recipient or its advisers will form the basis of any contract or commitment whatsoever. In particular, in furnishing the information, the Company, the Banks, their affiliates, shareholders, and their respective directors, officers, advisers, employees or representatives undertake no obligation to provide the recipient with access to any additional information

APPENDIX 1A – GEOGRAPHIC BREAKDOWN

|

Actual figures |

2019/20 |

% |

2020/21 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Europe |

6,092 |

74% |

2,674 |

59% |

|

Americas |

504 |

6% |

324 |

7% |

|

Asia / Pacific |

1,531 |

19% |

611 |

14% |

|

Middle East / Africa |

54 |

1% |

879 |

20% |

|

Orders by destination |

8,181 |

100% |

4,488 |

100% |

|

Actual figures |

2019/20 |

% |

2020/21 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Europe |

3,500 |

56% |

3,263 |

59% |

|

Americas |

1,015 |

16% |

902 |

16% |

|

Asia / Pacific |

655 |

11% |

671 |

12% |

|

Middle East / Africa |

1,030 |

17% |

731 |

13% |

|

Sales by destination |

6,200 |

100% |

5,567 |

100% |

APPENDIX 1B – PRODUCT BREAKDOWN

|

Actual figures |

2019/20 |

% |

2020/21 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Rolling stock |

4,099 |

50% |

1,370 |

30% |

|

Services |

2,719 |

33% |

1,251 |

28% |

|

Systems |

91 |

1% |

847 |

19% |

|

Signalling |

1,272 |

16% |

1,020 |

23% |

|

Orders by destination |

8,181 |

100% |

4,488 |

100% |

|

Actual figures |

2019/20 |

% |

2020/21 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Rolling stock |

2,897 |

47% |

2,781 |

50% |

|

Services |

1,109 |

18% |

1,013 |

18% |

|

Systems |

1,078 |

17% |

657 |

12% |

|

Signalling |

1,116 |

18% |

1,116 |

20% |

|

Sales by destination |

6,200 |

100% |

5,567 |

100% |

APPENDIX 2 - NON-GAAP FINANCIAL INDICATORS DEFINITIONS

This section presents financial indicators used by the Group that are not defined by accounting standard setters.

Orders received

A new order is recognised as an order received only when the contract creates enforceable obligations between the Group and its customer.

When this condition is met, the order is recognised at the contract value.

If the contract is denominated in a currency other than the functional currency of the reporting unit, the Group requires the immediate elimination of currency exposure through the use of forward currency sales. Orders are then measured using the spot rate at inception of hedging instruments.

Order backlog

Order backlog represents sales not yet recognised on orders already received.

Order backlog at the end of a financial year is computed as follows:

- order backlog at the beginning of the year;

- plus new orders received during the year;

- less cancellations of orders recorded during the year;

- less sales recognised during the year.

The order backlog is also subject to changes in the scope of consolidation, contract price adjustments and foreign currency translation effects.

Order backlog corresponds to the transaction price allocated to the remaining performance obligations, as per IFRS 15 quantitative and qualitative disclosures requirement.

Book-to-Bill

The book-to-bill ratio is the ratio of orders received to the amount of sales traded for a specific period.

Adjusted EBIT

When Alstom’s new organisation was implemented in 2015, adjusted EBIT (“aEBIT”) became the Key Performance Indicator to present the level of recurring operational performance. This indicator is also aligned with market practice and comparable to direct competitors.

Going forward (1st application for Half Year 2019/2020 publication), Alstom has opted for the inclusion of the share in net income of the equity-accounted investments into the aEBIT when these are considered as part of the operating activities of the Group (because there are significant operational flows and/or common project execution with these entities), namely the CASCO Joint Venture. The company believes that bringing visibility over a key contributor to the Alstom signalling strategy will provide a fairer and more accurate picture of the overall commercial & operational performance of the Group. This change will also enable more comparability with what similar market players define as being part of their main non-GAAP ‘profit’ aggregate disclosure.

aEBIT corresponds to Earning Before Interests and Tax adjusted for the following elements:

- net restructuring expenses (including rationalization costs);

- tangibles and intangibles impairment;

- capital gains or loss/revaluation on investments disposals or controls changes of an entity;

- any other non-recurring items, such as some costs incurred to realize business combinations and amortisation of an asset exclusively valued in the context of business combination as well as litigation costs that have arisen outside the ordinary course of business;

- and including the share in net income of the operational equity-accounted investments.

A non-recurring item is a “one-off” exceptional item that is not supposed to occur again in following years and that is significant.

Adjusted EBIT margin corresponds to Adjusted EBIT in percentage of sales.

Free cash flow

Free cash flow is defined as net cash provided by operating activities less capital expenditures including capitalised development costs, net of proceeds from disposals of tangible and intangible assets. In particular, free cash flow does not include the proceeds from disposals of activity.

The most directly comparable financial measure to free cash flow calculated and presented in accordance with IFRS is net cash provided by operating activities.

Alstom uses the free cash flow both for internal analysis purposes as well as for external communication as the Group believes it provides accurate insight regarding the actual amount of cash generated or used by operations.

Net cash/(debt)

The net cash/(debt) is defined as cash and cash equivalents, other current financial assets and non-current financial assets directly associated to liabilities included in financial debt, less financial debt.

Pay-out ratio

The pay-out ratio is calculated by dividing the amount of the overall dividend with the "Net profit from continuing operations attributable to equity holders of the parent” as presented in the consolidated income statement

Organic basis

Figures given on an organic basis eliminate the impact of changes in scope of consolidation and changes resulting from the translation of the accounts into Euro following the variation of foreign currencies against the Euro. The Group uses figures prepared on an organic basis both for internal analysis and for external communication, as it believes they provide means to analyse and explain variations from one period to another. However, these figures are not measurements of performance under IFRS.

|

|

9 months 31 Dec. 2019 |

|

9 months 31 Dec. 2020 |

|

|

|

||||||

|

(in € million) |

Actual |

Exchange |

Scope impact |

Comparable |

|

Actual |

Exchange rate |

Scope impact |

Comparable |

|

% Var Act. |

% Var Org. |

|

Orders |

8,181 |

(91) |

|

8,090 |

|

4,488 |

|

|

4,488 |

|

(45)% |

(45)% |

|

Sales |

6,200 |

(169) |

|

6,031 |

|

5,567 |

|

|

5,567 |

|

(10)% |

(8)% |

[1] Lateral signalling is the signalling in force before the deployment of the European ERTMS signalling system. It is still used on the vast majority of lines (excluding high speed lines).

[2] Alstom standalone scope

[3] The fiscal year 2020/21 outlook assumes the absence of Covid-19 crisis-related production slowdowns, arising from partial or full lockdown situations, that would exceed the lockdown measures in place on the date of this document and affecting either Alstom or key suppliers. Also relating to the Covid-19 environment, it assumes that customer tendering schedules will not materially shift after the second semester and that train mileage for purposes of calculating indexed payments under maintenance contracts will not decrease very significantly during the remainder of the second semester

[4] Subject to the usual short-term volatility in the timing of receipt of down payments and milestone payments owed by customers